This article provides an updated list of the Dividend Contenders in 2025 and select financial data and analyses. The list and data are updated monthly.

The Dividend Contenders 2025 are companies on United States exchanges that have increased their dividend for 10 to 24 consecutive years. Although this feat seems straightforward, the list is relatively small, with only 348 companies. This number is out of nearly 6,000 companies listed on the New York Stock Exchange (NYSE) and NASDAQ, indicating a success rate of approximately 5.8%.

These companies may not have grown revenue and earnings per share yearly, but they raised the dividend without fail. Some of the Dividend Contenders 2025 will become Dividend Champions, and a few will become Dividend Kings. However, many companies will also drop off the Dividend Contenders list because they cannot sustain the dividend during economic distress, e.g., the COVID-19 pandemic or the Great Recession.

Affiliate

Stock Rover is an award winning investment research platform.

- The site has 8,500+ stocks, 4,000 ETFs, and 40,000 mutual funds.

- Access to 650+ metrics, financial data, market news, stock and fund ratings, fair value, margin of safety, etc.

- Includes brokerage integration, portfolio tracking, rebalancing, watchlists, alerts, future income forecasts, etc.

Click here to try Stock Rover for free (14-day free trial).

Market Update for the Dividend Contenders 2025

The Dividend Contenders 2025 are currently trading at an elevated valuation of a trailing average price-to-earnings ratio of about 22.32X. This multiple is down from its peak of more than 27X in May 2021.

The current average dividend yield is about 2.85%. The trailing average 10-year dividend growth rate is approximately 10.17%, and the average past 5-year dividend growth rate is around 8.81%. The average payout ratio is around 52.72%. The average market cap of the Dividend Contenders 2025 is currently $70,248 million.

Currently, the Dividend Contender with the highest yield is Community Healthcare Trust (CHCT), and the one trading with the lowest earnings multiple is Comcast (CMSCA).

The updated, selected financial data and the dividend earnings calendar for each stock in the Dividend Champions list are in the tables below. The most recent dividend increases are also available.

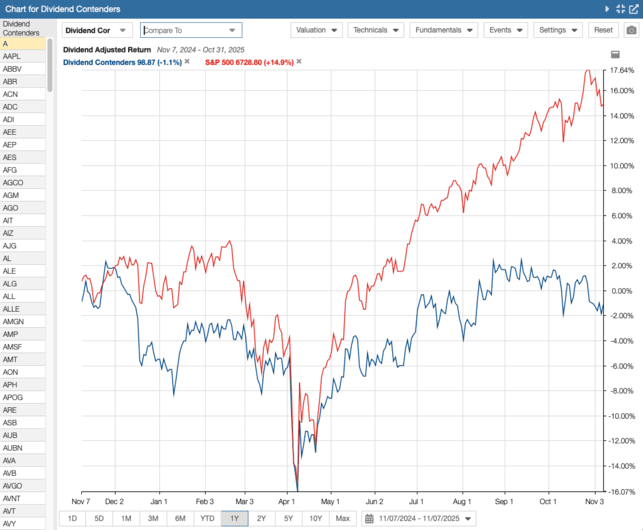

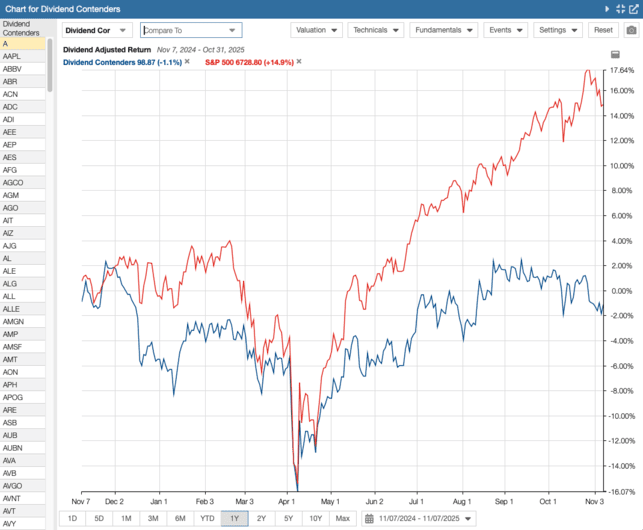

In the following 1-year period, the Dividend Contenders 2025 returned -1.1% (blue line) compared to +14.9% for the S&P 500 Index (red line), as seen in the chart below. We used Stock Rover* for this chart. Sign up for more data and screeners. Over the trailing 5-years, the Dividend Contenders 2025 have returned +93.7%, and the S&P 500 Index has returned +105.7%.

Source: Stock Rover*

Affiliate

Stock Rover is an award winning investment research platform.

- The site has 8,500+ stocks, 4,000 ETFs, and 40,000 mutual funds.

- Access to 650+ metrics, financial data, market news, stock and fund ratings, fair value, margin of safety, etc.

- Includes brokerage integration, portfolio tracking, rebalancing, watchlists, alerts, future income forecasts, etc.

- Plus export to spreadsheets, dividend calendar, 10+ years of data history, etc.

- Best Buy and Hold Screener by Investopedia

- Editor’s Choice by American Association of Individual Investors (AAII).

Click here to try Stock Rover for free (14-day free trial).

List of Dividend Contenders in 2025

Stock Rover* and Portfolio Insight* were used to create this table. Sign up to either one to gain access to data, charts, and screeners.

| Ticker | Company Name | No. Years | Dividend Yield (%) | 10-yr Dividend Growth Rate (%) | Payout Ratio (%) | TTM P/E Ratio | Market Cap (millions) |

|---|---|---|---|---|---|---|---|

| A | Agilent Technologies | 12 | 0.7 | 9.5 | 22.9 | 34.3 | $41,600 |

| AAPL | Apple | 12 | 0.4 | 7.2 | 13.6 | 36 | $3,967,007 |

| ABBV | AbbVie | 12 | 3.2 | 12.4 | 482.8 | n/a | $387,340 |

| ABR | Arbor Realty Trust | 12 | 13 | 7.2 | 184.8 | 11.7 | $1,806 |

| ACN | Accenture | 14 | 2.7 | 11.9 | 48.2 | 20.2 | $152,405 |

| ADC | Agree Realty | 13 | 4.3 | 5.5 | 178.6 | 42.9 | $8,467 |

| ADI | Analog Devices | 21 | 1.7 | 9.5 | 96.5 | 58.1 | $112,401 |

| AEE | Ameren | 11 | 2.7 | 5.6 | 53.5 | 20.1 | $28,307 |

| AEP | American Electric Power | 15 | 3.2 | 5.8 | 54.2 | 17.8 | $64,671 |

| AES | AES | 12 | 5 | 5.8 | 47.6 | 9.3 | $10,062 |

| AFG | American Financial Group | 20 | 2.5 | 12.1 | 33.6 | 15 | $11,931 |

| AGCO | AGCO | 11 | 1.1 | 9.2 | 23 | 21 | $7,877 |

| AGM | Federal Agricultural | 13 | 3.7 | 25.1 | 33.4 | 9.3 | $1,717 |

| AGO | Assured Guaranty | 13 | 1.6 | 11 | 14.1 | 10.7 | $4,134 |

| AIT | Applied Industrial Techs | 15 | 0.7 | 5.5 | 16.6 | 24.9 | $9,765 |

| AIZ | Assurant | 20 | 1.4 | 10.3 | 19.3 | 13.7 | $11,234 |

| AJG | Arthur J. Gallagher | 14 | 1 | 5.8 | 37.2 | 40 | $64,203 |

| AL | Air Lease | 11 | 1.4 | 18.6 | 10.2 | 7.4 | $7,132 |

| ALE | ALLETE | 14 | 4.3 | 3.8 | 101.2 | 23.6 | $3,917 |

| ALG | Alamo Group | 11 | 0.7 | 14.1 | 11.3 | 17.3 | $2,021 |

| ALL | Allstate | 14 | 2 | 12.8 | 12.5 | 6.6 | $52,935 |

| ALLE | Allegion | 10 | 1.2 | 17.7 | 27.1 | 22.6 | $14,397 |

| AMGN | Amgen | 13 | 3 | 11.7 | 72.1 | 24.8 | $172,421 |

| AMP | Ameriprise Finl | 19 | 1.4 | 9.1 | 16.7 | 12.7 | $42,720 |

| AMSF | AMERISAFE | 11 | 3.9 | 10 | 58.6 | 15.6 | $766 |

| AMT | American Tower | 12 | 3.8 | 14 | 107 | 28.4 | $83,306 |

| AON | Aon | 14 | 0.9 | 9.5 | 22.6 | 27.7 | $74,436 |

| APH | Amphenol | 13 | 0.7 | 16.8 | 21 | 46.3 | $170,253 |

| APOG | Apogee Enterprises | 14 | 3 | 9 | 50 | 16.7 | $740 |

| ARE | Alexandria Real Estate | 14 | 9.5 | 5.5 | n/a | n/a | $9,610 |

| ASB | Associated Banc | 31 | 3.8 | 8.7 | 104.6 | 29.8 | $4,242 |

| AUB | Atlantic Union Bankshares | 14 | 4.5 | 7.2 | 73.9 | 18.4 | $4,666 |

| AUBN | Auburn National Bancorp | 22 | 4.2 | 2.1 | 56.8 | 12.4 | $89 |

| AVA | Avista | 22 | 4.8 | 4 | 82.4 | 17.3 | $3,323 |

| AVGO | Broadcom | 14 | 0.7 | 30.2 | 57.1 | 89.3 | $1,650,372 |

| AVNT | Avient | 13 | 3.7 | 10.4 | 87.1 | 24.2 | $2,719 |

| AVT | Avnet | 11 | 3 | 7.5 | 49.1 | 17.5 | $3,843 |

| AVY | Avery Dennison | 14 | 2.2 | 9.8 | 41.3 | 19.8 | $13,454 |

| AWK | American Water Works Co | 16 | 2.5 | 9.3 | 56 | 23 | $25,529 |

| AXS | Axis Capital Holdings | 19 | 1.8 | 4.3 | 14.4 | 8.2 | $7,668 |

| BAC | Bank of America | 11 | 2.1 | 18.8 | 28.5 | 14.5 | $388,492 |

| BAH | Booz Allen Hamilton | 12 | 2.5 | 15.5 | 32.8 | 13.3 | $10,607 |

| BAM | Brookfield Asset Mgmt | 13 | 3.3 | n/a | 112 | 32.9 | $85,618 |

| BBY | Best Buy Co | 20 | 4.8 | 15.2 | 103.6 | 21.8 | $16,604 |

| BC | Brunswick | 12 | 2.6 | 13.2 | n/a | n/a | $4,276 |

| BCPC | Balchem | 15 | 0.6 | 11.2 | 18.9 | 33.3 | $4,940 |

| BF.A | Brown-Forman | 16 | 3.4 | 6 | 50.1 | 14.9 | $12,643 |

| BFC | Bank First | 11 | 1.5 | 13.2 | 25.3 | 17.5 | $1,220 |

| BHB | Bar Harbor Bankshares | 21 | 4.3 | 6.5 | 47.3 | 12.8 | $492 |

| BIP | Brookfield Infr Partners | 16 | 4.9 | 6.2 | 3340 | 52.6 | $16,310 |

| BK | Bank of New York Mellon | 15 | 1.9 | 12 | 27.8 | 15.8 | $76,457 |

| BLK | BlackRock | 15 | 1.9 | 9.1 | 52.7 | 27.9 | $167,904 |

| BMY | Bristol-Myers Squibb | 17 | 5.3 | 5.3 | 83.5 | 15.7 | $95,049 |

| BOKF | BOK Financial | 19 | 2.3 | 3.1 | 27.1 | 12.9 | $6,835 |

| BR | Broadridge Financial | 17 | 1.8 | 12.5 | 45.8 | 28.3 | $25,880 |

| CASS | Cass Information Sys | 20 | 3.2 | 6.9 | 52.3 | 19.5 | $517 |

| CBOE | Cboe Global Markets | 14 | 1.1 | 12.1 | 28 | 27.6 | $26,714 |

| CBT | Cabot | 13 | 2.9 | 7.4 | 22.5 | 10.2 | $3,248 |

| CCBG | Capital City Bank Group | 10 | 2.4 | 24.1 | 27.1 | 11.2 | $684 |

| CCOI | Cogent Comms Hldgs | 12 | 13 | 11.6 | n/a | n/a | $1,153 |

| CDW | CDW | 11 | 1.8 | 24.9 | 31.4 | 18 | $18,546 |

| CFFI | C&F Financial | 13 | 2.7 | 4.4 | 22.5 | 8.6 | $224 |

| CHCO | City Holding | 14 | 2.7 | 7.6 | 36.3 | 13.9 | $1,733 |

| CHCT | Community Healthcare | 10 | 13.1 | 13.9 | n/a | n/a | $411 |

| CHDN | Churchill Downs | 14 | 0.5 | 9.4 | 7.4 | 17.7 | $6,789 |

| CHE | Chemed | 16 | 0.6 | 9.6 | 11 | 23 | $6,001 |

| CIVB | Civista Bancshares | 13 | 3.1 | 13 | 26.1 | 8.2 | $422 |

| CMCSA | Comcast | 16 | 4.8 | 10.2 | 21.5 | 4.5 | $99,660 |

| CME | CME Group | 14 | 1.8 | 9.6 | 103.6 | 26.8 | $99,705 |

| CMI | Cummins | 19 | 1.7 | 7.4 | 38.4 | 24.5 | $65,338 |

| CMS | CMS Energy | 18 | 3 | 6.5 | 61.6 | 21.1 | $22,611 |

| CNO | CNO Finl Group | 12 | 1.7 | 9.3 | 22.2 | 14.1 | $3,933 |

| CNS | Cohen & Steers | 15 | 3.7 | 9.5 | 76.3 | 21.5 | $3,462 |

| COFS | ChoiceOne Finl Servs | 13 | 3.8 | 6.1 | 68.5 | 16 | $441 |

| COR | Cencora | 20 | 0.7 | 6.6 | 22 | 45.3 | $69,931 |

| COST | Costco Wholesale | 21 | 0.6 | 12.5 | 27 | 50.8 | $408,939 |

| CPK | Chesapeake Utilities | 21 | 2 | 9.1 | 46.4 | 24.1 | $3,211 |

| CPT | Camden Prop Trust | 14 | 4.1 | 4.1 | 290.9 | 41.2 | $10,875 |

| CSCO | Cisco Systems | 14 | 2.3 | 6.9 | 63.3 | 27.9 | $280,067 |

| CSGS | CSG Systems Intl | 11 | 1.6 | 6.2 | 42.3 | 26.7 | $2,233 |

| CSX | CSX | 20 | 1.5 | 8 | 33.1 | 22.9 | $65,807 |

| CTRE | CareTrust REIT | 10 | 3.7 | 7.7 | 94.5 | 26.6 | $8,072 |

| CUBE | CubeSmart | 14 | 5.5 | 12.5 | 132.5 | 24.2 | $8,560 |

| DDS | Dillard’s | 14 | 0.2 | 15.7 | 2.8 | 16.8 | $9,467 |

| DGICA | Donegal Gr | 22 | 3.8 | 3.1 | 29 | 7.9 | $684 |

| DGX | Quest Diagnostics | 14 | 1.8 | 7.7 | 36.5 | 21.1 | $19,968 |

| DHI | D.R. Horton | 10 | 1.2 | 20.4 | 12 | 12.5 | $42,631 |

| DHR | Danaher | 11 | 0.6 | 9 | 25.2 | 43.3 | $148,291 |

| DKL | Delek Logistics Partners | 12 | 10 | 7 | 149.8 | 15.2 | $2,387 |

| DKS | Dick’s Sporting Goods | 10 | 2.2 | 24.3 | 31.4 | 15.3 | $19,648 |

| DLB | Dolby Laboratories | 10 | 2 | 12.1 | 46.9 | 24 | $6,240 |

| DLR | Digital Realty Trust | 17 | 2.9 | 3.7 | 121.4 | 44.1 | $58,357 |

| DOX | Amdocs | 12 | 2.5 | 12 | 40.6 | 17.1 | $9,302 |

| DPZ | Domino’s Pizza | 11 | 1.7 | 18.8 | 39.1 | 24 | $13,858 |

| DTE | DTE Energy | 15 | 3.2 | 4.1 | 65.4 | 20.5 | $28,400 |

| DUK | Duke Energy | 14 | 3.4 | 2.6 | 68.1 | 19.5 | $96,161 |

| EBMT | Eagle Bancorp Montana | 14 | 3.5 | 6.5 | 32.9 | 9.6 | $131 |

| EFSC | Enterprise Finl Servs | 10 | 2.4 | 16 | 22.8 | 10.3 | $1,951 |

| EGP | EastGroup Properties | 15 | 3.2 | 10 | 120.3 | 37.3 | $9,480 |

| EIX | Edison Intl | 20 | 5.8 | 7.1 | 43.2 | 7.5 | $21,948 |

| ELS | Equity Lifestyle Props | 20 | 3.3 | 10.6 | 101.1 | 31.1 | $12,040 |

| ELV | Elevance Health | 13 | 2.2 | 10.6 | 27.5 | 13 | $70,623 |

| EMN | Eastman Chemical | 15 | 5.4 | 7.6 | 54.9 | 10.2 | $6,986 |

| ENSG | Ensign Group | 17 | 0.1 | 5.2 | 4.4 | 32.2 | $10,424 |

| ES | Eversource Energy | 24 | 4.1 | 6.1 | 82.1 | 20.2 | $27,403 |

| ETN | Eaton Corp | 15 | 1.1 | 6.6 | 40.5 | 37.5 | $145,565 |

| ETR | Entergy | 10 | 2.6 | 3.8 | 58 | 23.9 | $43,404 |

| EVR | Evercore | 17 | 1.1 | 11.6 | 24 | 24.4 | $11,856 |

| EVRG | Evergy | 21 | 3.7 | 6.4 | 72.4 | 20.7 | $17,401 |

| EXPO | Exponent | 11 | 1.7 | 14.9 | 57.7 | 34.7 | $3,563 |

| FAF | First American Financial | 14 | 3.5 | 8.2 | 46.6 | 13.4 | $6,355 |

| FBIZ | First Business Finl Servs | 12 | 2.3 | 10.2 | 18.5 | 8.5 | $428 |

| FCBC | First Community | 13 | 3.8 | 8.3 | 45.4 | 12.2 | $600 |

| FDBC | Fidelity D & D Bancorp | 10 | 3.7 | 8.3 | 38.3 | 9.8 | $255 |

| FFIN | First Finl Bankshares | 14 | 2.4 | 9 | 42.4 | 18.6 | $4,461 |

| FITB | Fifth Third Bancorp | 14 | 3.7 | 11.9 | 44.8 | 12.8 | $28,337 |

| FIX | Comfort Systems USA | 12 | 0.2 | 22.6 | 7.2 | 40.5 | $33,693 |

| FLO | Flowers Foods | 11 | 8.3 | 5.5 | 106 | 13 | $2,506 |

| FMAO | Farmers & Merchants | 19 | 3.7 | 7.5 | 28.5 | 10.5 | $336 |

| FMBH | First Mid Bancshares | 15 | 2.7 | 5.4 | 27.2 | 10.1 | $883 |

| FNF | Fidelity National Finl | 13 | 3.7 | 9.1 | 50.3 | 13.4 | $15,460 |

| FNLC | First Bancorp | 11 | 5.9 | 5.3 | 52.9 | 9.4 | $283 |

| FNV | Franco-Nevada | 15 | 0.8 | 6.2 | 31.5 | 40.3 | $37,822 |

| FR | First Industrial Realty | 11 | 3.2 | 13.3 | 95.3 | 31.5 | $7,452 |

| FRME | First Merchants | 13 | 4 | 12.6 | 35.4 | 9 | $2,082 |

| FSBW | FS Bancorp | 12 | 2.7 | 23.1 | 25.8 | 10 | $311 |

| FSFG | First Savings Financial | 11 | 2.1 | 14.9 | 19.8 | 9 | $208 |

| FULT | Fulton Financial | 15 | 4.1 | 7.2 | 41.3 | 9.2 | $3,188 |

| GABC | German American Bancorp | 12 | 3 | 9.9 | 39.5 | 13.7 | $1,487 |

| GATX | GATX | 14 | 1.6 | 4.8 | 28.1 | 18.1 | $5,533 |

| GFF | Griffon | 13 | 1 | 16.2 | 46.3 | 49.8 | $3,359 |

| GL | Globe Life | 19 | 0.8 | 7.2 | 7.5 | 9.6 | $10,527 |

| GRC | Gorman-Rupp | 11 | 1.7 | 6.3 | 38.7 | 23.3 | $1,170 |

| GS | Goldman Sachs Group | 13 | 2 | 19.9 | 26.1 | 16 | $235,845 |

| GTY | Getty Realty | 12 | 7.1 | 7 | 146.9 | 21.3 | $1,576 |

| HBCP | Home Bancorp | 11 | 2.1 | 14.3 | 19.2 | 9.6 | $421 |

| HD | Home Depot | 15 | 2.5 | 14.6 | 61.7 | 25.3 | $369,397 |

| HEI | Heico | 17 | 0.1 | 12.8 | 5 | 70.9 | $39,211 |

| HFBL | Home Federal Bancorp Inc | 12 | 3.4 | 12.9 | 40.9 | 10.9 | $48 |

| HFWA | Heritage Financial | 13 | 4.4 | 8.1 | 64.8 | 13.4 | $748 |

| HI | Hillenbrand | 16 | 2.8 | 1.2 | n/a | n/a | $2,233 |

| HIFS | Hingham Institution | 13 | 0.9 | 8.4 | 16.3 | 14 | $629 |

| HIG | The Hartford Insurance Gr | 12 | 1.9 | 9.5 | 16.8 | 10.6 | $36,060 |

| HII | Huntington Ingalls Indus | 12 | 1.8 | 12.9 | 37.2 | 21.4 | $12,318 |

| HMN | Horace Mann Educators | 15 | 3.1 | 3.4 | 40.7 | 11.5 | $1,845 |

| HNI | HNI | 14 | 3.5 | 2.5 | 44.1 | 13.3 | $1,808 |

| HOMB | Home BancShares | 14 | 3.1 | 10.3 | 34.2 | 12 | $5,400 |

| HON | Honeywell Intl | 16 | 2.4 | 8.1 | 47.4 | 20.5 | $123,212 |

| HPQ | HP | 14 | 4.4 | 5.1 | 41.4 | 9.6 | $24,563 |

| HSY | Hershey | 15 | 3.2 | 8.9 | 79.7 | 25.5 | $34,597 |

| HUBB | Hubbell | 17 | 1.2 | 9 | 32.8 | 28.9 | $24,575 |

| HUM | Humana | 12 | 1.4 | 11.8 | 33 | 23.6 | $30,313 |

| HVT | Haverty Furniture Cos | 12 | 5.8 | 12.3 | 107.6 | 18.8 | $355 |

| HWBK | Hawthorn Bancshares | 14 | 2.6 | 18.1 | 25.9 | 9.8 | $216 |

| HWKN | Hawkins | 14 | 0.6 | 6.9 | 18.3 | 32.3 | $2,672 |

| HY | Hyster Yale | 12 | 4.2 | 2.4 | 887.5 | n/a | $604 |

| IBCP | Independent Bank | 10 | 3.4 | 12.5 | 31 | 9.4 | $634 |

| IBOC | International Bancshares | 16 | 2.1 | 9.2 | 20.7 | 9.9 | $4,176 |

| ICE | Intercontinental Exchange | 11 | 1.3 | 12.3 | 34.3 | 27.2 | $84,956 |

| IDA | Idacorp | 14 | 2.7 | 5.6 | 58.8 | 22.3 | $7,043 |

| IEX | IDEX | 15 | 1.7 | 8.3 | 44.2 | 26.6 | $12,571 |

| INDB | Independent Bank | 14 | 3.4 | 8.5 | 57.6 | 17.4 | $3,494 |

| INGR | Ingredion | 14 | 3 | 6.2 | 30.7 | 10.8 | $6,910 |

| INTU | Intuit | 14 | 0.7 | 14.9 | 30.1 | 47.4 | $180,902 |

| IOSP | Innospec | 11 | 2.3 | 10.8 | n/a | n/a | $1,894 |

| IPG | The Interpublic Group | 12 | 5.2 | 10.6 | 110.9 | 21.6 | $9,325 |

| ISTR | Investar Holding | 10 | 1.9 | 30 | 18.7 | 10.7 | $232 |

| ITT | ITT | 12 | 0.8 | 11.5 | 22.8 | 31.5 | $14,678 |

| JBHT | JB Hunt Transport Servs | 20 | 1 | 7.7 | 30.2 | 29.6 | $16,321 |

| JJSF | J&J Snack Foods | 20 | 3.9 | 8.3 | 72.6 | 19.1 | $1,591 |

| JOUT | Johnson Outdoors | 10 | 3.4 | 15.2 | n/a | n/a | $404 |

| JPM | JPMorgan Chase | 15 | 1.9 | 13 | 27.4 | 15.6 | $855,361 |

| K | Kellanova | 20 | 2.8 | 1.5 | 62.1 | 22.8 | $28,996 |

| KAI | Kadant | 12 | 0.5 | 7.2 | 15.2 | 31.2 | $3,169 |

| KLAC | KLA | 15 | 0.6 | 13.8 | 22.5 | 37.5 | $156,799 |

| KR | Kroger | 18 | 2.2 | 12.8 | 32.2 | 16.5 | $43,014 |

| KWR | Quaker Houghton | 18 | 1.5 | 4.7 | n/a | n/a | $2,390 |

| LAD | Lithia Motors | 14 | 0.8 | 10.6 | 6.2 | 8.5 | $7,111 |

| LAND | Gladstone Land | 10 | 6 | 1.6 | n/a | n/a | $349 |

| LARK | Landmark Bancorp | 21 | 3.3 | 6.1 | 29 | 8.3 | $149 |

| LFUS | Littelfuse | 14 | 1.2 | 10 | 59.4 | 51 | $6,049 |

| LHX | L3Harris Technologies | 23 | 1.7 | 9.1 | 51 | 31.3 | $54,464 |

| LII | Lennox Intl | 15 | 1.1 | 13.7 | 20.6 | 20.8 | $17,263 |

| LKFN | Lakeland Financial | 13 | 3.5 | 11.8 | 52.1 | 15.3 | $1,477 |

| LLY | Eli Lilly | 10 | 0.7 | 11.6 | 28.3 | 45.3 | $827,328 |

| LMAT | LeMaitre Vascular | 13 | 0.9 | 17.5 | 34.5 | 37.5 | $1,965 |

| LMT | Lockheed Martin | 22 | 3 | 8.2 | 73.3 | 25.5 | $106,061 |

| LNN | Lindsay | 22 | 1.3 | 2.8 | 21.3 | 16.4 | $1,197 |

| LNT | Alliant Energy | 22 | 3 | 6.3 | 61 | 20.8 | $17,309 |

| LOGI | Logitech International | 12 | 1.3 | 9.4 | 35.6 | 27.4 | $17,600 |

| LRCX | Lam Research | 10 | 0.7 | 24.1 | 20.9 | 35.2 | $200,148 |

| LSTR | Landstar System | 10 | 1.2 | 17.5 | 38.9 | 33.3 | $4,469 |

| LYB | LyondellBasell Industries | 11 | 12.7 | 5.8 | n/a | n/a | $13,891 |

| MA | Mastercard | 14 | 0.6 | 16.9 | 18.8 | 35.3 | $495,666 |

| MAA | Mid-America Apartment | 15 | 4.7 | 7 | 127.4 | 27.5 | $15,179 |

| MAIN | Main Street Capital | 17 | 7.4 | 5 | 68.8 | 9.7 | $5,249 |

| MAN | ManpowerGroup | 14 | 5 | -1 | n/a | n/a | $1,329 |

| MAS | Masco | 11 | 2 | 12.6 | 31.1 | 15.9 | $12,875 |

| MATX | Matson | 12 | 1.3 | 7.2 | 10.4 | 8.5 | $3,467 |

| MBWM | Mercantile Bank | 13 | 3.4 | 9.7 | 28.1 | 8.6 | $733 |

| MCHP | Microchip Technology | 22 | 3.2 | 9.8 | n/a | n/a | $30,416 |

| MCK | McKesson | 17 | 0.4 | 11.3 | 9.2 | 26.7 | $105,158 |

| MCO | Moodys | 15 | 0.8 | 10.7 | 29.4 | 39.2 | $87,055 |

| MDLZ | Mondelez International | 11 | 3.5 | 11.4 | 71 | 21.4 | $73,782 |

| MET | MetLife | 13 | 3 | 4.2 | 37.2 | 14.1 | $50,312 |

| MGA | Magna International | 15 | 3.9 | 8.2 | 52.9 | 13.7 | $14,068 |

| MKTX | MarketAxess Holdings | 15 | 1.8 | 14.3 | 50.4 | 28.5 | $6,249 |

| MLM | Martin Marietta Materials | 10 | 0.5 | 7.6 | 16.8 | 31.4 | $36,825 |

| MMC | Marsh & McLennan Cos | 16 | 2 | 11.2 | 40.8 | 21.6 | $88,208 |

| MORN | Morningstar | 13 | 0.8 | 9.1 | 20.6 | 24.5 | $8,862 |

| MPLX | MPLX | 12 | 8.4 | 8.6 | 81.1 | 10.9 | $52,144 |

| MRK | Merck & Co | 14 | 3.8 | 6.1 | 42.8 | 11.4 | $214,148 |

| MS | Morgan Stanley | 12 | 2.5 | 20.9 | 38.3 | 16.6 | $258,040 |

| MSCI | MSCI | 10 | 1.2 | 24.6 | 44.3 | 36.9 | $43,795 |

| MSEX | Middlesex Water | 21 | 2.6 | 5.9 | 56.9 | 22.4 | $982 |

| MSFT | Microsoft | 20 | 0.7 | 10.3 | 23.5 | 35.3 | $3,692,553 |

| MSI | Motorola Solutions | 13 | 1.1 | 12.4 | 34.4 | 31.4 | $65,081 |

| MTRN | Materion | 12 | 0.5 | 4.5 | 59.1 | 125 | $2,407 |

| MWA | Mueller Water Products | 10 | 1.1 | 12.9 | 27.9 | 25.5 | $3,727 |

| NBTB | NBT Bancorp | 12 | 3.6 | 5.3 | 48.9 | 13.8 | $2,180 |

| NDAQ | Nasdaq | 12 | 1.2 | 12.5 | 36 | 31.2 | $49,813 |

| NHC | National Healthcare | 20 | 2 | 4.8 | 36.4 | 19.6 | $1,973 |

| NKE | Nike | 23 | 2.6 | 11.1 | 81.6 | 31.4 | $90,303 |

| NNI | Nelnet | 10 | 1 | 11.6 | 12.4 | 11.1 | $4,767 |

| NOC | Northrop Grumman | 21 | 1.6 | 11.2 | 31.4 | 20.5 | $81,152 |

| NRIM | Northrim BanCorp | 15 | 2.8 | 12.9 | 22.2 | 8.2 | $504 |

| NSP | Insperity | 14 | 7.1 | 18.5 | 500 | 70.4 | $1,276 |

| NWE | NorthWestern Energy Group | 19 | 4.1 | 3.2 | 74.3 | 18.4 | $3,992 |

| NXST | Nexstar Media Gr | 11 | 3.9 | 25.6 | 44.8 | 11.9 | $5,781 |

| OC | Owens-Corning | 10 | 2.7 | 15 | n/a | n/a | $8,564 |

| ODC | Oil-Dri Corp of America | 11 | 1.2 | 5.5 | 15.5 | 15.1 | $819 |

| OGE | OGE Energy | 19 | 3.8 | 4.4 | 67.6 | 17.8 | $8,928 |

| OGS | ONE Gas | 10 | 3.3 | 8.4 | 62 | 19.2 | $4,933 |

| ORCL | Oracle | 11 | 0.8 | 12.8 | 40.5 | 55.3 | $682,080 |

| OSK | Oshkosh | 11 | 1.7 | 11.6 | 19.3 | 11.9 | $7,682 |

| OTEX | Open Text | 11 | 3.1 | 10.6 | 55.3 | 18.1 | $8,722 |

| OTTR | Otter Tail | 11 | 2.5 | 5.5 | 30.7 | 12.8 | $3,541 |

| OVLY | Oak Valley | 11 | 2.1 | 10.6 | 17.8 | 10 | $237 |

| PAYX | Paychex | 11 | 3.9 | 9.9 | 92 | 25.1 | $40,293 |

| PB | Prosperity Bancshares | 21 | 3.6 | 7.8 | 41.8 | 12.1 | $6,414 |

| PCAR | PACCAR | 17 | 1.3 | 7.5 | 25.2 | 19.3 | $51,837 |

| PEBO | Peoples Bancorp | 10 | 5.7 | 10.6 | 55.9 | 10.1 | $1,033 |

| PEG | Public Service Enterprise | 13 | 3 | 4.9 | 59.6 | 20 | $41,584 |

| PFE | Pfizer | 15 | 7 | 4.4 | 98.8 | 14.2 | $141,347 |

| PFG | Principal Financial Group | 16 | 3.8 | 7.5 | 43.8 | 12.2 | $18,203 |

| PLD | Prologis | 11 | 3.2 | 9.7 | 115.7 | 36.5 | $116,665 |

| PM | Philip Morris Intl | 16 | 3.8 | 3.7 | 99.8 | 21.9 | $238,772 |

| PNC | PNC Financial Services Gr | 15 | 3.7 | 12.8 | 41.9 | 11.9 | $72,235 |

| PNW | Pinnacle West Capital | 14 | 4.1 | 3.8 | 72.2 | 18.2 | $10,529 |

| POOL | Pool | 14 | 2 | 17 | 44.5 | 23 | $9,387 |

| POR | Portland Gen Electric | 18 | 4.4 | 5.8 | 74.3 | 17.4 | $5,382 |

| POWI | Power Integrations | 12 | 2.4 | 13.3 | 262.5 | n/a | $1,953 |

| PRGO | Perrigo | 21 | 8 | 8.8 | n/a | n/a | $1,987 |

| PRI | Primerica | 14 | 1.7 | 20.6 | 18.5 | 11.6 | $8,062 |

| PRU | Prudential Financial | 16 | 5.1 | 8.8 | 72.9 | 14.6 | $37,193 |

| PSX | Phillips 66 | 12 | 3.5 | 7.9 | 126.7 | 37.2 | $55,582 |

| QCOM | Qualcomm | 21 | 2.1 | 6.4 | 68.9 | 34.1 | $183,023 |

| QSR | Restaurant Brands Intl | 13 | 3.7 | 18.9 | 86.2 | 24 | $22,256 |

| R | Ryder System | 20 | 2 | 8.3 | 27.7 | 14.3 | $6,840 |

| RBA | RB Global | 20 | 1.2 | 6.8 | 55.7 | 47.9 | $18,526 |

| REG | Regency Centers | 13 | 4.3 | 3.8 | 128.8 | 32.1 | $12,761 |

| REXR | Rexford Industrial Realty | 11 | 4.1 | 12.3 | 120.3 | 29.5 | $9,740 |

| RF | Regions Finl | 12 | 4.3 | 16 | 44.5 | 11 | $21,790 |

| RGA | Reinsurance Gr | 15 | 1.9 | 9.7 | 27.4 | 14.7 | $12,453 |

| RGCO | RGC Resources | 22 | 4 | 4.9 | 61.7 | 15.9 | $215 |

| RGLD | Royal Gold | 23 | 1 | 7.4 | 24.7 | 24.2 | $14,838 |

| RHI | Robert Half | 20 | 9 | 11.4 | 148.4 | 17.1 | $2,668 |

| RJF | Raymond James Finl | 15 | 1.2 | 15.3 | 18.7 | 15.9 | $32,312 |

| RMD | ResMed | 12 | 1 | 7.2 | 22.3 | 25.8 | $36,709 |

| ROK | Rockwell Automation | 15 | 1.5 | 7.3 | 60.6 | 43.9 | $41,993 |

| RS | Reliance | 14 | 1.7 | 11.6 | 34 | 20 | $14,390 |

| RSG | Republic Services | 21 | 1.2 | 7.6 | 35.1 | 30.6 | $63,643 |

| SBFG | SB Finl Gr | 11 | 2.8 | 12.2 | 31.7 | 10.4 | $138 |

| SBUX | Starbucks | 14 | 2.9 | 14.3 | 103 | 52.6 | $97,284 |

| SCI | Service Corp Intl | 14 | 1.7 | 10.3 | 33.7 | 21.7 | $11,297 |

| SCVL | Shoe Carnival | 13 | 3.5 | 16.5 | 24.8 | 7.7 | $476 |

| SFBS | Servisfirst Bancshares | 10 | 1.9 | 27.3 | 28.6 | 15.4 | $3,919 |

| SFNC | Simmons First Ntl | 13 | 4.8 | 6.3 | n/a | n/a | $2,591 |

| SGU | Star Group | 13 | 6.3 | 6.9 | 41.6 | 6.9 | $392 |

| SIGI | Selective Insurance Gr | 11 | 2.2 | 10.5 | 23.2 | 12.1 | $4,727 |

| SLGN | Silgan Hldgs | 21 | 2.1 | 9.6 | 26.8 | 13 | $4,036 |

| SMBC | Southern Missouri Bancorp | 13 | 1.9 | 10.8 | 17.7 | 9.8 | $604 |

| SNA | Snap-on | 15 | 2.8 | 15 | 44.1 | 18 | $17,875 |

| SO | Southern | 23 | 3.2 | 3.2 | 72.1 | 22.7 | $100,685 |

| SR | Spire | 21 | 3.5 | 5.5 | 68.1 | 19.7 | $5,293 |

| SRE | Sempra | 14 | 2.8 | 6.3 | 78.6 | 28.8 | $61,169 |

| SSB | SouthState Bank | 14 | 2.7 | 8.7 | 30.3 | 12.1 | $8,830 |

| SSD | Simpson Manufacturing Co | 11 | 0.7 | 6.1 | 14.3 | 20.8 | $7,106 |

| STAG | Stag Industrial | 13 | 3.8 | 0.8 | 114.4 | 30 | $7,306 |

| STBA | S&T Bancorp | 12 | 3.8 | 6.6 | 39.5 | 11.1 | $1,462 |

| STE | Steris | 14 | 1 | 9.7 | 33.4 | 37.7 | $25,888 |

| STLD | Steel Dynamics | 12 | 1.3 | 13.8 | 25.9 | 20.1 | $22,188 |

| STT | State Street | 14 | 2.8 | 9.5 | 32.6 | 12.6 | $33,045 |

| STZ | Constellation Brands | 10 | 3.2 | 15.9 | 59.1 | 18.6 | $22,343 |

| SWKS | Skyworks Solutions | 10 | 4.1 | 10.6 | 110.7 | 22.6 | $10,346 |

| SXI | Standex International | 15 | 0.6 | 9.3 | 29.1 | 54.4 | $2,873 |

| SYBT | Stock Yards Bancorp | 15 | 1.9 | 7.2 | 27.1 | 14.6 | $1,972 |

| TCBK | TriCo Bancshares | 12 | 3 | 10.7 | 38.8 | 13.3 | $1,459 |

| TEL | TE Connectivity | 14 | 1.2 | 8 | 54.4 | 39.4 | $71,406 |

| THG | The Hanover Insurance Gr | 18 | 2 | 8.2 | 20.5 | 10.4 | $6,389 |

| THO | Thor Industries | 14 | 2 | 5.7 | 41.1 | 21.5 | $5,486 |

| TKR | Timken | 11 | 1.8 | 3 | 32.5 | 18.7 | $5,502 |

| TOWN | Towne Bank | 13 | 3.3 | 8.4 | 46.2 | 14.8 | $2,603 |

| TRN | Trinity Indus | 15 | 4.7 | 10.6 | 100.9 | 20.8 | $2,056 |

| TRNO | Terreno Realty | 13 | 3.4 | 12.5 | 63 | 19.3 | $6,270 |

| TRV | Travelers Companies | 19 | 1.6 | 6.1 | 16.7 | 11 | $62,415 |

| TSBK | Timberland Bancorp | 11 | 3.2 | 14 | 29.3 | 9 | $260 |

| TSCO | Tractor Supply | 14 | 1.7 | 19.1 | 43.8 | 26.3 | $28,676 |

| TSN | Tyson Foods | 13 | 3.8 | 17.5 | 88.1 | 23.9 | $18,741 |

| TTC | Toro | 21 | 2.1 | 11.8 | 45.3 | 22.1 | $7,154 |

| TTEK | Tetra Tech | 10 | 0.8 | 15 | 29.5 | 40.3 | $8,465 |

| TXN | Texas Instruments | 20 | 3.5 | 14.1 | 98.6 | 29.2 | $145,879 |

| TXNM | TXNM Energy | 14 | 2.8 | 7.4 | 89.4 | 31.9 | $6,245 |

| UBCP | United Bancorp | 11 | 5.9 | 7.6 | 57.1 | 10 | $73 |

| UCB | United Community Banks | 10 | 3.3 | 15.3 | 43.6 | 11.9 | $3,642 |

| UDR | UDR | 16 | 5 | 4.5 | 388.6 | 78.1 | $11,391 |

| UFPI | UFP Industries | 12 | 1.5 | 17.7 | 25.5 | 17 | $5,362 |

| UNH | UnitedHealth Group | 15 | 2.7 | 16 | 44.7 | 16.9 | $293,681 |

| UNM | Unum Gr | 17 | 2.4 | 9.5 | 33.1 | 15.1 | $13,076 |

| UNP | Union Pacific | 18 | 2.5 | 9.6 | 45.8 | 18.8 | $131,373 |

| UNTY | Unity Bancorp | 11 | 1.3 | 15.2 | 10.7 | 8.9 | $468 |

| UPS | United Parcel Service | 15 | 6.8 | 8.4 | 101.1 | 14.8 | $81,402 |

| USB | U.S. Bancorp | 14 | 4.4 | 7.4 | 46.1 | 10.8 | $73,555 |

| UTL | Unitil | 10 | 3.8 | 2.5 | 62.1 | 16.8 | $857 |

| UTMD | Utah Medical Products | 20 | 2.2 | 1.8 | 32.4 | 16.2 | $183 |

| V | Visa | 16 | 0.8 | 17.3 | 23.1 | 32.9 | $648,484 |

| VALU | Value Line | 11 | 3.5 | 7.3 | 55.1 | 16.6 | $354 |

| VMC | Vulcan Materials | 11 | 0.7 | 17.2 | 22.8 | 33.9 | $37,896 |

| VZ | Verizon Communications | 20 | 6.9 | 2 | 57.9 | 8.5 | $168,783 |

| WAFD | WaFd | 15 | 3.6 | 7.6 | 40.3 | 11.5 | $2,361 |

| WASH | Washington Trust Bancorp | 14 | 8 | 5.1 | n/a | n/a | $535 |

| WCN | Waste Connections | 17 | 0.8 | 13.7 | 52.3 | 69.4 | $42,634 |

| WDFC | WD-40 | 15 | 1.9 | 9.5 | 55.2 | 29.7 | $2,682 |

| WEC | WEC Energy Group | 21 | 3.2 | 14.3 | 66.3 | 21.4 | $36,715 |

| WLK | Westlake | 20 | 3.3 | 11.3 | n/a | n/a | $8,331 |

| WM | Waste Management | 21 | 1.6 | 7.9 | 50.6 | 31.9 | $81,346 |

| WMS | Advanced Drainage Systems | 10 | 0.5 | 14.3 | 11.5 | 25.3 | $11,510 |

| WRB | WR Berkley | 19 | 0.5 | 9.7 | 7.1 | 15.8 | $28,490 |

| WSBC | Wesbanco | 14 | 4.8 | 4.9 | 83.5 | 14.6 | $2,968 |

| WSM | Williams-Sonoma | 19 | 1.3 | 14.2 | 27 | 21.9 | $24,071 |

| WSO | Watsco | 12 | 3.4 | 15.7 | 84.4 | 27.3 | $14,303 |

| WTFC | Wintrust Financial | 12 | 1.5 | 16.3 | 17.7 | 12 | $8,781 |

| WTS | Watts Water Technologies | 12 | 0.8 | 11.8 | 19.6 | 28.2 | $9,112 |

| XEL | Xcel Energy | 21 | 2.8 | 5.9 | 68.6 | 24.7 | $47,808 |

| XRAY | Dentsply Sirona | 13 | 5.7 | 8.2 | n/a | n/a | $2,230 |

| XYL | Xylem | 13 | 1.1 | 11 | 40 | 39.1 | $36,839 |

| ZION | Zions Bancorp | 12 | 3.5 | 22.3 | 31 | 9.4 | $7,712 |

| ZTS | Zoetis | 11 | 1.7 | 19.7 | 32.5 | 20.2 | $52,988 |

Dividend Calendar for the Dividend Contenders 2025

Stock Rover* and Portfolio Insight* were used to create this table. Sign up to track your dividends and income.

| Ticker | Company | Ex-Div. Date | Div. Record Date | Div. Payment Date | Div. Frequency | Next Div. Payment Per Share | Fwd. Div. Per Share |

|---|---|---|---|---|---|---|---|

| A | Agilent Technologies | 9/30/25 | 9/30/25 | 10/22/25 | 4 | $0.25 | $0.99 |

| AAPL | Apple | 11/10/25 | 11/10/25 | 11/13/25 | 4 | $0.26 | $1.04 |

| ABBV | AbbVie | 1/16/26 | 1/16/26 | 2/17/26 | 4 | $1.73 | $6.92 |

| ABR | Arbor Realty Trust | 11/14/25 | 11/14/25 | 11/26/25 | 4 | $0.30 | $1.20 |

| ACN | Accenture | 10/10/25 | 10/10/25 | 11/14/25 | 4 | $1.63 | $6.52 |

| ADC | Agree Realty | 10/31/25 | 10/31/25 | 11/14/25 | 12 | $0.26 | $3.14 |

| ADI | Analog Devices | 9/2/25 | 9/2/25 | 9/16/25 | 4 | $0.99 | $3.96 |

| AEE | Ameren | 12/9/25 | 12/9/25 | 12/31/25 | 4 | $0.71 | $2.84 |

| AEP | American Electric Power | 11/10/25 | 11/10/25 | 12/10/25 | 4 | $0.95 | $3.80 |

| AES | AES | 10/31/25 | 10/31/25 | 11/14/25 | 4 | $0.18 | $0.70 |

| AFG | American Financial Group | 11/17/25 | 11/17/25 | 11/26/25 | 4 | $0.88 | $3.52 |

| AGCO | AGCO | 11/14/25 | 11/14/25 | 12/15/25 | 4 | $0.29 | $1.16 |

| AGM | Federal Agricultural | 12/15/25 | 12/15/25 | 12/31/25 | 4 | $1.50 | $6.00 |

| AGO | Assured Guaranty | 11/19/25 | 11/19/25 | 12/3/25 | 4 | $0.34 | $1.36 |

| AIT | Applied Industrial Techs | 11/14/25 | 11/14/25 | 11/28/25 | 4 | $0.46 | $1.84 |

| AIZ | Assurant | 9/2/25 | 9/2/25 | 9/29/25 | 4 | $0.80 | $3.20 |

| AJG | Arthur J. Gallagher | 12/5/25 | 12/5/25 | 12/19/25 | 4 | $0.65 | $2.60 |

| AL | Air Lease | 12/4/25 | 12/4/25 | 1/8/26 | 4 | $0.22 | $0.88 |

| ALE | ALLETE | 8/15/25 | 8/15/25 | 9/1/25 | 4 | $0.73 | $2.92 |

| ALG | Alamo Group | 10/15/25 | 10/15/25 | 10/28/25 | 4 | $0.30 | $1.20 |

| ALL | Allstate | 8/29/25 | 8/29/25 | 10/1/25 | 4 | $1.00 | $4.00 |

| ALLE | Allegion | 9/15/25 | 9/15/25 | 9/30/25 | 4 | $0.51 | $2.04 |

| AMGN | Amgen | 11/21/25 | 11/21/25 | 12/12/25 | 4 | $2.38 | $9.52 |

| AMP | Ameriprise Finl | 11/10/25 | 11/10/25 | 11/24/25 | 4 | $1.60 | $6.40 |

| AMSF | AMERISAFE | 12/5/25 | 12/5/25 | 12/12/25 | 4 | $0.39 | $1.56 |

| AMT | American Tower | 9/30/25 | 9/30/25 | 10/20/25 | 4 | $1.70 | $6.80 |

| AON | Aon | 11/3/25 | 11/3/25 | 11/14/25 | 4 | $0.75 | $2.98 |

| APH | Amphenol | 12/16/25 | 12/16/25 | 1/7/26 | 4 | $0.25 | $1.00 |

| APOG | Apogee Enterprises | 10/29/25 | 10/29/25 | 11/13/25 | 4 | $0.26 | $1.04 |

| ARE | Alexandria Real Estate | 9/30/25 | 9/30/25 | 10/15/25 | 4 | $1.32 | $5.28 |

| ASB | Associated Banc | 12/1/25 | 12/1/25 | 12/15/25 | 4 | $0.24 | $0.96 |

| AUB | Atlantic Union Bankshares | 11/14/25 | 11/14/25 | 11/28/25 | 4 | $0.37 | $1.48 |

| AUBN | Auburn National Bancorp | 9/10/25 | 9/10/25 | 9/25/25 | 4 | $0.27 | $1.08 |

| AVA | Avista | 8/19/25 | 8/19/25 | 9/15/25 | 4 | $0.49 | $1.96 |

| AVB | AvalonBay Communities | 9/30/25 | 9/30/25 | 10/15/25 | 4 | $1.75 | $7.00 |

| AVGO | Broadcom | 9/22/25 | 9/22/25 | 9/30/25 | 4 | $0.59 | $2.36 |

| AVNT | Avient | 12/12/25 | 12/12/25 | 1/7/26 | 4 | $0.28 | $1.10 |

| AVT | Avnet | 9/17/25 | 9/17/25 | 9/26/25 | 4 | $0.35 | $1.40 |

| AVY | Avery Dennison | 12/3/25 | 12/3/25 | 12/17/25 | 4 | $0.94 | $3.76 |

| AWK | American Water Works Co | 11/13/25 | 11/13/25 | 12/2/25 | 4 | $0.83 | $3.31 |

| AXS | Axis Capital Holdings | 9/30/25 | 9/30/25 | 10/17/25 | 4 | $0.44 | $1.76 |

| BAC | Bank of America | 12/5/25 | 12/5/25 | 12/26/25 | 4 | $0.28 | $1.12 |

| BAH | Booz Allen Hamilton | 11/14/25 | 11/14/25 | 12/2/25 | 4 | $0.55 | $2.20 |

| BAM | Brookfield Asset Mgmt | 11/28/25 | 11/28/25 | 12/31/25 | 4 | $0.44 | $1.75 |

| BBY | Best Buy Co | 9/18/25 | 9/18/25 | 10/9/25 | 4 | $0.95 | $3.80 |

| BC | Brunswick | 11/26/25 | 11/26/25 | 12/15/25 | 4 | $0.43 | $1.72 |

| BCPC | Balchem | 12/26/24 | 12/26/24 | 1/17/25 | 1 | $0.87 | $0.87 |

| BF.A | Brown-Forman | 9/3/25 | 9/3/25 | 10/1/25 | 4 | $0.23 | $0.91 |

| BFC | Bank First | 12/24/25 | 12/24/25 | 1/7/26 | 4 | $0.45 | $1.80 |

| BHB | Bar Harbor Bankshares | 11/20/25 | 11/20/25 | 12/19/25 | 4 | $0.32 | $1.28 |

| BIP | Brookfield Infr Partners | 8/29/25 | 8/29/25 | 9/29/25 | 4 | $0.43 | $1.72 |

| BK | Bank of New York Mellon | 10/27/25 | 10/27/25 | 11/7/25 | 4 | $0.53 | $2.12 |

| BLK | BlackRock | 9/5/25 | 9/5/25 | 9/23/25 | 4 | $5.21 | $20.84 |

| BMY | Bristol-Myers Squibb | 10/3/25 | 10/3/25 | 11/3/25 | 4 | $0.62 | $2.48 |

| BOKF | BOK Financial | 11/12/25 | 11/12/25 | 11/26/25 | 4 | $0.63 | $2.52 |

| BR | Broadridge Financial | 9/11/25 | 9/11/25 | 10/2/25 | 4 | $0.98 | $3.90 |

| BWXT | BWX Technologies | 11/19/25 | 11/19/25 | 12/10/25 | 4 | $0.25 | $1.00 |

| CASS | Cass Information Sys | 12/5/25 | 12/5/25 | 12/15/25 | 4 | $0.32 | $1.28 |

| CBOE | Cboe Global Markets | 11/28/25 | 11/28/25 | 12/15/25 | 4 | $0.72 | $2.88 |

| CBT | Cabot | 8/29/25 | 8/29/25 | 9/11/25 | 4 | $0.45 | $1.80 |

| CCBG | Capital City Bank Group | 9/8/25 | 9/8/25 | 9/22/25 | 4 | $0.26 | $0.97 |

| CCOI | Cogent Comms Hldgs | 11/21/25 | 11/21/25 | 12/8/25 | 4 | $0.02 | $3.05 |

| CDW | CDW | 11/25/25 | 11/25/25 | 12/10/25 | 4 | $0.63 | $2.52 |

| CFFI | C&F Financial | 9/15/25 | 9/15/25 | 10/1/25 | 4 | $0.46 | $1.84 |

| CHCO | City Holding | 10/15/25 | 10/15/25 | 10/31/25 | 4 | $0.87 | $3.24 |

| CHCT | Community Healthcare | 11/7/25 | 11/7/25 | 11/21/25 | 4 | $0.47 | $1.90 |

| CHDN | Churchill Downs | 12/5/25 | 12/5/25 | 1/6/26 | 1 | $0.44 | $0.44 |

| CHE | Chemed | 8/11/25 | 8/11/25 | 8/29/25 | 4 | $0.60 | $2.40 |

| CIVB | Civista Bancshares | 11/4/25 | 11/4/25 | 11/18/25 | 4 | $0.17 | $0.68 |

| CMCSA | Comcast | 1/14/26 | 1/14/26 | 2/4/26 | 4 | $0.33 | $1.32 |

| CME | CME Group | 12/12/25 | 12/12/25 | 12/30/25 | 4 | $1.25 | $5.00 |

| CMI | Cummins | 11/21/25 | 11/21/25 | 12/4/25 | 4 | $2.00 | $8.00 |

| CMS | CMS Energy | 11/7/25 | 11/7/25 | 11/26/25 | 4 | $0.54 | $2.17 |

| CNO | CNO Finl Group | 9/10/25 | 9/10/25 | 9/24/25 | 4 | $0.17 | $0.68 |

| CNS | Cohen & Steers | 11/10/25 | 11/10/25 | 11/20/25 | 4 | $0.62 | $2.48 |

| COFS | ChoiceOne Finl Servs | 9/15/25 | 9/15/25 | 9/30/25 | 4 | $0.28 | $1.12 |

| COR | Cencora | 11/14/25 | 11/14/25 | 12/1/25 | 4 | $0.60 | $2.40 |

| COST | Costco Wholesale | 10/31/25 | 10/31/25 | 11/14/25 | 4 | $1.30 | $5.20 |

| CPK | Chesapeake Utilities | 12/15/25 | 12/15/25 | 1/5/26 | 4 | $0.69 | $2.74 |

| CPT | Camden Prop Trust | 9/30/25 | 9/30/25 | 10/17/25 | 4 | $1.05 | $4.20 |

| CSCO | Cisco Systems | 10/3/25 | 10/3/25 | 10/22/25 | 4 | $0.41 | $1.64 |

| CSGS | CSG Systems Intl | 9/19/25 | 9/19/25 | 10/3/25 | 4 | $0.32 | $1.28 |

| CSX | CSX | 11/28/25 | 11/28/25 | 12/15/25 | 4 | $0.13 | $0.52 |

| CTRE | CareTrust REIT | 9/30/25 | 9/30/25 | 10/15/25 | 4 | $0.34 | $1.34 |

| CUBE | CubeSmart | 10/1/25 | 10/1/25 | 10/15/25 | 4 | $0.52 | $2.08 |

| DDS | Dillard’s | 9/30/25 | 9/30/25 | 11/3/25 | 4 | $0.30 | $1.20 |

| DGICA | Donegal Gr | 11/3/25 | 11/3/25 | 11/17/25 | 4 | $0.18 | $0.73 |

| DGX | Quest Diagnostics | 10/3/25 | 10/3/25 | 10/20/25 | 4 | $0.80 | $3.20 |

| DHI | D.R. Horton | 11/13/25 | 11/13/25 | 11/20/25 | 4 | $0.45 | $1.80 |

| DHR | Danaher | 9/26/25 | 9/26/25 | 10/31/25 | 4 | $0.32 | $1.28 |

| DKL | Delek Logistics Partners | 11/7/25 | 11/7/25 | 11/13/25 | 4 | $1.12 | $4.48 |

| DKS | Dick’s Sporting Goods | 9/12/25 | 9/12/25 | 9/26/25 | 4 | $1.21 | $4.85 |

| DLB | Dolby Laboratories | 8/12/25 | 8/12/25 | 8/20/25 | 4 | $0.33 | $1.32 |

| DLR | Digital Realty Trust | 12/15/25 | 12/15/25 | 1/16/26 | 4 | $1.22 | $4.88 |

| DOX | Amdocs | 9/30/25 | 9/30/25 | 10/31/25 | 4 | $0.53 | $2.11 |

| DPZ | Domino’s Pizza | 12/15/25 | 12/15/25 | 12/26/25 | 4 | $1.74 | $6.96 |

| DTE | DTE Energy | 9/15/25 | 9/15/25 | 10/15/25 | 4 | $1.09 | $4.36 |

| DUK | Duke Energy | 11/14/25 | 11/14/25 | 12/16/25 | 4 | $1.07 | $4.26 |

| EBMT | Eagle Bancorp Montana | 11/14/25 | 11/14/25 | 12/5/25 | 4 | $0.14 | $0.58 |

| EFSC | Enterprise Finl Servs | 12/15/25 | 12/15/25 | 12/31/25 | 4 | $0.32 | $1.28 |

| EGP | EastGroup Properties | 9/30/25 | 9/30/25 | 10/15/25 | 4 | $1.55 | $5.75 |

| ELS | Equity Lifestyle Props | 12/26/25 | 12/26/25 | 1/9/26 | 4 | $0.51 | $2.06 |

| ELV | Elevance Health | 12/5/25 | 12/5/25 | 12/19/25 | 4 | $1.71 | $6.84 |

| EMN | Eastman Chemical | 9/15/25 | 9/15/25 | 10/7/25 | 4 | $0.83 | $3.32 |

| ENSG | Ensign Group | 9/30/25 | 9/30/25 | 10/31/25 | 4 | $0.06 | $0.25 |

| EQIX | Equinix | 11/19/25 | 11/19/25 | 12/17/25 | 4 | $4.69 | $18.76 |

| ES | Eversource Energy | 9/22/25 | 9/22/25 | 9/30/25 | 4 | $0.75 | $3.01 |

| ETN | Eaton Corp | 11/6/25 | 11/6/25 | 11/21/25 | 4 | $1.04 | $4.16 |

| ETR | Entergy | 11/13/25 | 11/13/25 | 12/1/25 | 4 | $0.64 | $2.56 |

| EVR | Evercore | 11/28/25 | 11/28/25 | 12/12/25 | 4 | $0.84 | $3.36 |

| EVRG | Evergy | 11/21/25 | 11/21/25 | 12/19/25 | 4 | $0.69 | $2.78 |

| EXPO | Exponent | 12/5/25 | 12/5/25 | 12/19/25 | 4 | $0.30 | $1.20 |

| FAF | First American Financial | 12/8/25 | 12/8/25 | 12/15/25 | 4 | $0.55 | $2.20 |

| FBIZ | First Business Finl Servs | 11/19/25 | 11/19/25 | 12/3/25 | 4 | $0.29 | $1.16 |

| FCBC | First Community | 11/14/25 | 11/14/25 | 11/28/25 | 4 | $0.31 | $1.24 |

| FDBC | Fidelity D & D Bancorp | 11/14/25 | 11/14/25 | 12/10/25 | 4 | $0.43 | $1.63 |

| FFIN | First Finl Bankshares | 12/15/25 | 12/15/25 | 1/2/26 | 4 | $0.19 | $0.76 |

| FITB | Fifth Third Bancorp | 9/30/25 | 9/30/25 | 10/15/25 | 4 | $0.40 | $1.60 |

| FIX | Comfort Systems USA | 11/13/25 | 11/13/25 | 11/24/25 | 4 | $0.60 | $1.95 |

| FLO | Flowers Foods | 9/5/25 | 9/5/25 | 9/19/25 | 4 | $0.25 | $0.99 |

| FMAO | Farmers & Merchants | 10/10/25 | 10/10/25 | 10/20/25 | 4 | $0.23 | $0.91 |

| FMBH | First Mid Bancshares | 11/14/25 | 11/14/25 | 12/1/25 | 4 | $0.25 | $1.00 |

| FNF | Fidelity National Finl | 12/17/25 | 12/17/25 | 12/31/25 | 4 | $0.52 | $2.08 |

| FNLC | First Bancorp | 10/6/25 | 10/6/25 | 10/16/25 | 4 | $0.37 | $1.48 |

| FNV | Franco-Nevada | 9/11/25 | 9/11/25 | 9/25/25 | 4 | $0.38 | $1.52 |

| FR | First Industrial Realty | 12/31/25 | 12/31/25 | 1/20/26 | 4 | $0.44 | $1.78 |

| FRME | First Merchants | 9/5/25 | 9/5/25 | 9/19/25 | 4 | $0.36 | $1.44 |

| FSBW | FS Bancorp | 11/6/25 | 11/6/25 | 11/20/25 | 4 | $0.28 | $1.12 |

| FSFG | First Savings Financial | 9/15/25 | 9/15/25 | 9/30/25 | 4 | $0.16 | $0.64 |

| FULT | Fulton Financial | 10/1/25 | 10/1/25 | 10/15/25 | 4 | $0.18 | $0.72 |

| GABC | German American Bancorp | 11/10/25 | 11/10/25 | 11/20/25 | 4 | $0.29 | $1.16 |

| GATX | GATX | 12/15/25 | 12/15/25 | 12/31/25 | 4 | $0.61 | $2.44 |

| GFF | Griffon | 8/29/25 | 8/29/25 | 9/16/25 | 4 | $0.18 | $0.72 |

| GL | Globe Life | 1/5/26 | 1/5/26 | 1/30/26 | 4 | $0.27 | $1.08 |

| GRC | Gorman-Rupp | 11/14/25 | 11/14/25 | 12/10/25 | 4 | $0.19 | $0.76 |

| GS | Goldman Sachs Group | 12/2/25 | 12/2/25 | 12/30/25 | 4 | $4.00 | $16.00 |

| GTY | Getty Realty | 12/26/25 | 12/26/25 | 1/8/26 | 4 | $0.49 | $1.94 |

| HBCP | Home Bancorp | 11/3/25 | 11/3/25 | 11/14/25 | 4 | $0.31 | $1.14 |

| HD | Home Depot | 9/4/25 | 9/4/25 | 9/18/25 | 4 | $2.30 | $9.20 |

| HEI | Heico | 7/1/25 | 7/1/25 | 7/15/25 | 2 | $0.12 | $0.24 |

| HFBL | Home Federal Bancorp Inc | 10/27/25 | 10/27/25 | 11/10/25 | 4 | $0.14 | $0.54 |

| HFWA | Heritage Financial | 11/5/25 | 11/5/25 | 11/19/25 | 4 | $0.24 | $0.96 |

| HI | Hillenbrand | 9/15/25 | 9/15/25 | 9/30/25 | 4 | $0.22 | $0.90 |

| HIFS | Hingham Institution | 11/3/25 | 11/3/25 | 11/12/25 | 4 | $0.63 | $2.52 |

| HIG | The Hartford Insurance Gr | 12/1/25 | 12/1/25 | 1/5/26 | 4 | $0.60 | $2.40 |

| HII | Huntington Ingalls Indus | 11/28/25 | 11/28/25 | 12/12/25 | 4 | $1.38 | $5.52 |

| HMN | Horace Mann Educators | 9/16/25 | 9/16/25 | 9/30/25 | 4 | $0.35 | $1.40 |

| HNI | HNI | 11/17/25 | 11/17/25 | 12/1/25 | 4 | $0.34 | $1.36 |

| HOMB | Home BancShares | 11/12/25 | 11/12/25 | 12/3/25 | 4 | $0.21 | $0.84 |

| HON | Honeywell Intl | 11/14/25 | 11/14/25 | 12/5/25 | 4 | $1.19 | $4.58 |

| HPQ | HP | 9/10/25 | 9/10/25 | 10/1/25 | 4 | $0.29 | $1.16 |

| HSY | Hershey | 11/17/25 | 11/17/25 | 12/15/25 | 4 | $1.37 | $5.48 |

| HUBB | Hubbell | 11/28/25 | 11/28/25 | 12/15/25 | 4 | $1.42 | $5.68 |

| HUM | Humana | 12/26/25 | 12/26/25 | 1/30/26 | 4 | $0.88 | $3.54 |

| HVT | Haverty Furniture Cos | 8/25/25 | 8/25/25 | 9/10/25 | 4 | $0.32 | $1.28 |

| HWBK | Hawthorn Bancshares | 12/15/25 | 12/15/25 | 1/1/26 | 4 | $0.20 | $0.80 |

| HWKN | Hawkins | 11/14/25 | 11/14/25 | 11/28/25 | 4 | $0.19 | $0.76 |

| HY | Hyster Yale | 8/29/25 | 8/29/25 | 9/16/25 | 4 | $0.36 | $1.42 |

| IBCP | Independent Bank | 11/4/25 | 11/4/25 | 11/14/25 | 4 | $0.26 | $1.04 |

| IBOC | International Bancshares | 8/15/25 | 8/15/25 | 8/29/25 | 2 | $0.70 | $1.40 |

| ICE | Intercontinental Exchange | 12/16/25 | 12/16/25 | 12/31/25 | 4 | $0.48 | $1.92 |

| IDA | Idacorp | 11/5/25 | 11/5/25 | 12/1/25 | 4 | $0.88 | $3.52 |

| IEX | IDEX | 10/10/25 | 10/10/25 | 10/24/25 | 4 | $0.71 | $2.84 |

| INDB | Independent Bank | 9/29/25 | 9/29/25 | 10/7/25 | 4 | $0.59 | $2.36 |

| INGR | Ingredion | 10/1/25 | 10/1/25 | 10/21/25 | 4 | $0.82 | $3.28 |

| INTU | Intuit | 10/9/25 | 10/9/25 | 10/17/25 | 4 | $1.20 | $4.32 |

| IOSP | Innospec | 11/18/25 | 11/18/25 | 11/26/25 | 2 | $0.87 | $1.74 |

| IPG | The Interpublic Group | 9/2/25 | 9/2/25 | 9/16/25 | 4 | $0.33 | $1.32 |

| ISTR | Investar Holding | 9/30/25 | 9/30/25 | 10/31/25 | 4 | $0.11 | $0.44 |

| ITT | ITT | 12/1/25 | 12/1/25 | 12/31/25 | 4 | $0.35 | $1.40 |

| JBHT | JB Hunt Transport Servs | 11/7/25 | 11/7/25 | 11/21/25 | 4 | $0.44 | $1.76 |

| JJSF | J&J Snack Foods | 9/16/25 | 9/16/25 | 10/7/25 | 4 | $0.80 | $3.20 |

| JOUT | Johnson Outdoors | 10/10/25 | 10/10/25 | 10/24/25 | 4 | $0.33 | $1.32 |

| JPM | JPMorgan Chase | 10/6/25 | 10/6/25 | 10/31/25 | 4 | $1.50 | $6.00 |

| K | Kellanova | 12/1/25 | 12/1/25 | 12/15/25 | 4 | $0.58 | $2.32 |

| KAI | Kadant | 10/9/25 | 10/9/25 | 11/6/25 | 4 | $0.34 | $1.36 |

| KLAC | KLA | 11/17/25 | 11/17/25 | 12/2/25 | 4 | $1.90 | $7.60 |

| KR | Kroger | 11/14/25 | 11/14/25 | 12/1/25 | 4 | $0.35 | $1.40 |

| KWR | Quaker Houghton | 10/17/25 | 10/17/25 | 10/31/25 | 4 | $0.51 | $2.03 |

| LAD | Lithia Motors | 11/7/25 | 11/7/25 | 11/21/25 | 4 | $0.55 | $2.20 |

| LAND | Gladstone Land | 11/17/25 | 11/17/25 | 11/26/25 | 12 | $0.05 | $0.56 |

| LARK | Landmark Bancorp | 11/12/25 | 11/12/25 | 11/26/25 | 4 | $0.21 | $0.84 |

| LFUS | Littelfuse | 11/20/25 | 11/20/25 | 12/4/25 | 4 | $0.75 | $3.00 |

| LHX | L3Harris Technologies | 11/17/25 | 11/17/25 | 12/5/25 | 4 | $1.20 | $4.80 |

| LII | Lennox Intl | 9/30/25 | 9/30/25 | 10/15/25 | 4 | $1.30 | $5.20 |

| LKFN | Lakeland Financial | 10/24/25 | 10/25/25 | 11/5/25 | 4 | $0.50 | $2.00 |

| LLY | Eli Lilly | 11/14/25 | 11/14/25 | 12/10/25 | 4 | $1.50 | $6.00 |

| LMAT | LeMaitre Vascular | 11/20/25 | 11/20/25 | 12/4/25 | 4 | $0.20 | $0.80 |

| LMT | Lockheed Martin | 12/1/25 | 12/1/25 | 12/30/25 | 4 | $3.45 | $13.80 |

| LNN | Lindsay | 11/14/25 | 11/14/25 | 11/28/25 | 4 | $0.37 | $1.48 |

| LNT | Alliant Energy | 10/31/25 | 10/31/25 | 11/17/25 | 4 | $0.51 | $2.03 |

| LOGI | Logitech International | 9/23/25 | 9/23/25 | 9/24/25 | 1 | $1.57 | $1.59 |

| LRCX | Lam Research | 12/3/25 | 12/3/25 | 1/7/26 | 4 | $0.26 | $1.04 |

| LSTR | Landstar System | 11/18/25 | 11/18/25 | 12/9/25 | 4 | $0.40 | $1.60 |

| LYB | LyondellBasell Industries | 8/25/25 | 8/25/25 | 9/2/25 | 4 | $1.37 | $5.48 |

| MA | Mastercard | 10/9/25 | 10/9/25 | 11/7/25 | 4 | $0.76 | $3.04 |

| MAA | Mid-America Apartment | 10/15/25 | 10/15/25 | 10/31/25 | 4 | $1.51 | $6.06 |

| MAIN | Main Street Capital | 12/8/25 | 12/8/25 | 12/15/25 | 12 | $0.26 | $4.32 |

| MAN | ManpowerGroup | 6/2/25 | 6/2/25 | 6/16/25 | 2 | $0.72 | $1.44 |

| MAS | Masco | 11/7/25 | 11/7/25 | 11/24/25 | 4 | $0.31 | $1.24 |

| MATX | Matson | 11/6/25 | 11/6/25 | 12/4/25 | 4 | $0.36 | $1.44 |

| MBWM | Mercantile Bank | 12/5/25 | 12/5/25 | 12/17/25 | 4 | $0.38 | $1.52 |

| MCHP | Microchip Technology | 11/24/25 | 11/24/25 | 12/9/25 | 4 | $0.46 | $1.82 |

| MCK | McKesson | 12/1/25 | 12/1/25 | 1/2/26 | 4 | $0.82 | $3.28 |

| MCO | Moodys | 11/21/25 | 11/21/25 | 12/12/25 | 4 | $0.94 | $3.76 |

| MDLZ | Mondelez International | 9/30/25 | 9/30/25 | 10/14/25 | 4 | $0.50 | $2.00 |

| MET | MetLife | 11/4/25 | 11/4/25 | 12/9/25 | 4 | $0.57 | $2.27 |

| MGA | Magna International | 11/14/25 | 11/14/25 | 11/28/25 | 4 | $0.49 | $1.94 |

| MKTX | MarketAxess Holdings | 11/19/25 | 11/19/25 | 12/3/25 | 4 | $0.76 | $3.04 |

| MLM | Martin Marietta Materials | 9/2/25 | 9/2/25 | 9/30/25 | 4 | $0.83 | $3.32 |

| MMC | Marsh & McLennan Cos | 10/2/25 | 10/2/25 | 11/14/25 | 4 | $0.90 | $3.60 |

| MORN | Morningstar | 10/3/25 | 10/3/25 | 10/31/25 | 4 | $0.46 | $1.82 |

| MPLX | MPLX | 11/7/25 | 11/7/25 | 11/14/25 | 4 | $1.08 | $4.31 |

| MRK | Merck & Co | 9/15/25 | 9/15/25 | 10/7/25 | 4 | $0.81 | $3.24 |

| MS | Morgan Stanley | 10/31/25 | 10/31/25 | 11/14/25 | 4 | $1.00 | $4.00 |

| MSCI | MSCI | 11/14/25 | 11/14/25 | 11/28/25 | 4 | $1.80 | $7.20 |

| MSEX | Middlesex Water | 11/17/25 | 11/17/25 | 12/1/25 | 4 | $0.36 | $1.38 |

| MSFT | Microsoft | 11/20/25 | 11/20/25 | 12/11/25 | 4 | $0.91 | $3.64 |

| MSI | Motorola Solutions | 9/15/25 | 9/15/25 | 10/15/25 | 4 | $1.09 | $4.36 |

| MTRN | Materion | 11/13/25 | 11/13/25 | 12/5/25 | 4 | $0.14 | $0.56 |

| MWA | Mueller Water Products | 11/10/25 | 11/10/25 | 11/20/25 | 4 | $0.07 | $0.27 |

| NBTB | NBT Bancorp | 12/1/25 | 12/1/25 | 12/15/25 | 4 | $0.37 | $1.48 |

| NDAQ | Nasdaq | 12/5/25 | 12/5/25 | 12/19/25 | 4 | $0.27 | $1.08 |

| NHC | National Healthcare | 12/31/25 | 12/31/25 | 1/30/26 | 4 | $0.64 | $2.56 |

| NKE | Nike | 9/2/25 | 9/2/25 | 10/1/25 | 4 | $0.40 | $1.60 |

| NNI | Nelnet | 12/1/25 | 12/1/25 | 12/15/25 | 4 | $0.33 | $1.32 |

| NOC | Northrop Grumman | 9/2/25 | 9/2/25 | 9/17/25 | 4 | $2.31 | $9.24 |

| NRIM | Northrim BanCorp | 9/4/25 | 9/4/25 | 9/12/25 | 4 | $0.16 | $0.64 |

| NSP | Insperity | 9/4/25 | 9/4/25 | 9/18/25 | 4 | $0.60 | $2.40 |

| NWE | NorthWestern Energy Group | 12/15/25 | 12/15/25 | 12/31/25 | 4 | $0.66 | $2.64 |

| NXST | Nexstar Media Gr | 11/12/25 | 11/12/25 | 11/26/25 | 4 | $1.86 | $7.44 |

| OC | Owens-Corning | 10/20/25 | 10/20/25 | 11/6/25 | 4 | $0.69 | $2.76 |

| ODC | Oil-Dri Corp of America | 11/7/25 | 11/7/25 | 11/21/25 | 4 | $0.18 | $0.67 |

| OGE | OGE Energy | 10/6/25 | 10/6/25 | 10/31/25 | 4 | $0.43 | $1.70 |

| OGS | ONE Gas | 11/14/25 | 11/14/25 | 12/1/25 | 4 | $0.67 | $2.68 |

| ORCL | Oracle | 10/9/25 | 10/9/25 | 10/23/25 | 4 | $0.50 | $2.00 |

| OSK | Oshkosh | 11/17/25 | 11/17/25 | 12/1/25 | 4 | $0.51 | $2.04 |

| OTEX | Open Text | 12/5/25 | 12/5/25 | 12/19/25 | 4 | $0.28 | $1.08 |

| OTTR | Otter Tail | 11/14/25 | 11/14/25 | 12/10/25 | 4 | $0.52 | $2.10 |

| OVLY | Oak Valley | 7/28/25 | 7/28/25 | 8/8/25 | 2 | $0.30 | $0.60 |

| PAYX | Paychex | 11/7/25 | 11/7/25 | 11/26/25 | 4 | $1.08 | $4.32 |

| PB | Prosperity Bancshares | 12/15/25 | 12/15/25 | 1/2/26 | 4 | $0.60 | $2.40 |

| PCAR | PACCAR | 11/12/25 | 11/12/25 | 12/3/25 | 4 | $0.33 | $1.32 |

| PEBO | Peoples Bancorp | 11/4/25 | 11/4/25 | 11/18/25 | 4 | $0.41 | $1.64 |

| PEG | Public Service Enterprise | 9/9/25 | 9/9/25 | 9/30/25 | 4 | $0.63 | $2.52 |

| PFE | Pfizer | 11/7/25 | 11/7/25 | 12/1/25 | 4 | $0.43 | $1.72 |

| PFG | Principal Financial Group | 12/3/25 | 12/3/25 | 12/19/25 | 4 | $0.79 | $3.16 |

| PLD | Prologis | 9/16/25 | 9/16/25 | 9/30/25 | 4 | $1.01 | $4.04 |

| PM | Philip Morris Intl | 10/3/25 | 10/3/25 | 10/20/25 | 4 | $1.47 | $5.88 |

| PNC | PNC Financial Services Gr | 10/14/25 | 10/14/25 | 11/5/25 | 4 | $1.70 | $6.80 |

| PNW | Pinnacle West Capital | 11/3/25 | 11/3/25 | 12/1/25 | 4 | $0.91 | $3.64 |

| POOL | Pool | 11/12/25 | 11/12/25 | 11/26/25 | 4 | $1.25 | $5.00 |

| POR | Portland Gen Electric | 12/22/25 | 12/22/25 | 1/15/26 | 4 | $0.52 | $2.10 |

| POWI | Power Integrations | 11/28/25 | 11/28/25 | 12/31/25 | 4 | $0.21 | $0.84 |

| PRGO | Perrigo | 11/28/25 | 11/28/25 | 12/16/25 | 4 | $0.29 | $1.16 |

| PRI | Primerica | 11/21/25 | 11/21/25 | 12/15/25 | 4 | $1.04 | $4.16 |

| PRU | Prudential Financial | 11/18/25 | 11/18/25 | 12/11/25 | 4 | $1.35 | $5.40 |

| PSX | Phillips 66 | 11/17/25 | 11/17/25 | 12/1/25 | 4 | $1.20 | $4.80 |

| QCOM | Qualcomm | 12/4/25 | 12/4/25 | 12/18/25 | 4 | $0.89 | $3.56 |

| QSR | Restaurant Brands Intl | 12/23/25 | 12/23/25 | 1/6/26 | 4 | $0.62 | $2.48 |

| R | Ryder System | 11/17/25 | 11/17/25 | 12/19/25 | 4 | $0.91 | $3.44 |

| RBA | RB Global | 11/26/25 | 11/26/25 | 12/17/25 | 4 | $0.31 | $1.24 |

| REG | Regency Centers | 12/15/25 | 12/15/25 | 1/6/26 | 4 | $0.75 | $3.02 |

| REXR | Rexford Industrial Realty | 12/31/25 | 12/31/25 | 1/15/26 | 4 | $0.43 | $1.72 |

| RF | Regions Finl | 12/1/25 | 12/1/25 | 1/2/26 | 4 | $0.26 | $1.06 |

| RGA | Reinsurance Gr | 11/10/25 | 11/11/25 | 11/25/25 | 4 | $0.93 | $3.64 |

| RGCO | RGC Resources | 10/17/25 | 10/17/25 | 11/3/25 | 4 | $0.21 | $0.83 |

| RGLD | Royal Gold | 10/3/25 | 10/3/25 | 10/17/25 | 4 | $0.45 | $1.80 |

| RHI | Robert Half | 11/25/25 | 11/25/25 | 12/15/25 | 4 | $0.59 | $2.36 |

| RJF | Raymond James Finl | 10/1/25 | 10/1/25 | 10/15/25 | 4 | $0.50 | $2.00 |

| RMD | ResMed | 11/13/25 | 11/13/25 | 12/18/25 | 4 | $0.60 | $2.40 |

| ROK | Rockwell Automation | 11/17/25 | 11/17/25 | 12/10/25 | 4 | $1.38 | $5.52 |

| RS | Reliance | 11/21/25 | 11/21/25 | 12/5/25 | 4 | $1.20 | $4.80 |

| RSG | Republic Services | 1/2/26 | 1/2/26 | 1/15/26 | 4 | $0.62 | $2.50 |

| SBFG | SB Finl Gr | 11/14/25 | 11/14/25 | 11/28/25 | 4 | $0.16 | $0.62 |

| SBUX | Starbucks | 11/14/25 | 11/14/25 | 11/28/25 | 4 | $0.62 | $2.48 |

| SCI | Service Corp Intl | 12/15/25 | 12/15/25 | 12/31/25 | 4 | $0.34 | $1.36 |

| SCVL | Shoe Carnival | 10/6/25 | 10/6/25 | 10/20/25 | 4 | $0.15 | $0.60 |

| SFBS | Servisfirst Bancshares | 10/1/25 | 10/1/25 | 10/10/25 | 4 | $0.34 | $1.34 |

| SFNC | Simmons First Ntl | 9/15/25 | 9/15/25 | 10/1/25 | 4 | $0.21 | $0.85 |

| SGU | Star Group | 10/27/25 | 10/27/25 | 11/5/25 | 4 | $0.19 | $0.74 |

| SIGI | Selective Insurance Gr | 11/14/25 | 11/14/25 | 12/1/25 | 4 | $0.43 | $1.72 |

| SLGN | Silgan Hldgs | 12/1/25 | 12/1/25 | 12/15/25 | 4 | $0.20 | $0.80 |

| SMBC | Southern Missouri Bancorp | 11/14/25 | 11/14/25 | 11/28/25 | 4 | $0.25 | $1.00 |

| SNA | Snap-on | 11/21/25 | 11/21/25 | 12/10/25 | 4 | $2.44 | $9.76 |

| SO | Southern | 11/17/25 | 11/17/25 | 12/8/25 | 4 | $0.74 | $2.96 |

| SR | Spire | 9/11/25 | 9/11/25 | 10/2/25 | 4 | $0.79 | $3.14 |

| SRE | Sempra | 12/11/25 | 12/11/25 | 1/15/26 | 4 | $0.64 | $2.58 |

| SSB | SouthState Bank | 11/7/25 | 11/7/25 | 11/14/25 | 4 | $0.60 | $2.40 |

| SSD | Simpson Manufacturing Co | 1/2/26 | 1/2/26 | 1/22/26 | 4 | $0.29 | $1.16 |

| STAG | Stag Industrial | 11/28/25 | 11/28/25 | 12/15/25 | 12 | $0.12 | $1.49 |

| STBA | S&T Bancorp | 11/13/25 | 11/13/25 | 11/28/25 | 4 | $0.36 | $1.44 |

| STE | Steris | 11/18/25 | 11/18/25 | 12/18/25 | 4 | $0.63 | $2.52 |

| STLD | Steel Dynamics | 9/30/25 | 9/30/25 | 10/10/25 | 4 | $0.50 | $2.00 |

| STT | State Street | 10/1/25 | 10/1/25 | 10/14/25 | 4 | $0.84 | $3.36 |

| STZ | Constellation Brands | 10/30/25 | 10/30/25 | 11/13/25 | 4 | $1.02 | $4.08 |

| SWKS | Skyworks Solutions | 11/18/25 | 11/18/25 | 12/9/25 | 4 | $0.71 | $2.84 |

| SXI | Standex International | 11/7/25 | 11/7/25 | 11/21/25 | 4 | $0.34 | $1.36 |

| SYBT | Stock Yards Bancorp | 9/15/25 | 9/15/25 | 10/1/25 | 4 | $0.32 | $1.28 |

| TCBK | TriCo Bancshares | 9/5/25 | 9/5/25 | 9/19/25 | 4 | $0.36 | $1.35 |

| TEL | TE Connectivity | 11/21/25 | 11/21/25 | 12/12/25 | 4 | $0.71 | $2.84 |

| THG | The Hanover Insurance Gr | 9/12/25 | 9/12/25 | 9/26/25 | 4 | $0.90 | $3.60 |

| THO | Thor Industries | 10/23/25 | 10/23/25 | 11/6/25 | 4 | $0.52 | $2.08 |

| TKR | Timken | 8/19/25 | 8/19/25 | 8/29/25 | 4 | $0.35 | $1.40 |

| TOWN | Towne Bank | 9/29/25 | 9/29/25 | 10/10/25 | 4 | $0.27 | $1.08 |

| TRN | Trinity Indus | 10/15/25 | 10/15/25 | 10/31/25 | 4 | $0.30 | $1.20 |

| TRNO | Terreno Realty | 12/15/25 | 12/15/25 | 1/9/26 | 4 | $0.52 | $2.08 |

| TRV | Travelers Companies | 12/10/25 | 12/10/25 | 12/31/25 | 4 | $1.10 | $4.40 |

| TSBK | Timberland Bancorp | 11/14/25 | 11/14/25 | 11/28/25 | 4 | $0.28 | $1.05 |

| TSCO | Tractor Supply | 11/24/25 | 11/24/25 | 12/9/25 | 4 | $0.23 | $0.92 |

| TSN | Tyson Foods | 12/1/25 | 12/1/25 | 12/15/25 | 4 | $0.50 | $2.00 |

| TTC | Toro | 10/7/25 | 10/7/25 | 10/21/25 | 4 | $0.38 | $1.52 |

| TTEK | Tetra Tech | 8/15/25 | 8/15/25 | 8/29/25 | 4 | $0.06 | $0.26 |

| TXN | Texas Instruments | 10/31/25 | 10/31/25 | 11/12/25 | 4 | $1.42 | $5.68 |

| TXNM | TXNM Energy | 10/24/25 | 10/24/25 | 11/14/25 | 4 | $0.41 | $1.63 |

| UBCP | United Bancorp | 9/10/25 | 9/10/25 | 9/19/25 | 4 | $0.19 | $0.75 |

| UCB | United Community Banks | 9/15/25 | 9/15/25 | 10/3/25 | 4 | $0.25 | $1.00 |

| UDR | UDR | 10/9/25 | 10/9/25 | 10/31/25 | 4 | $0.43 | $1.72 |

| UFPI | UFP Industries | 12/1/25 | 12/1/25 | 12/15/25 | 4 | $0.35 | $1.40 |

| UNH | UnitedHealth Group | 12/8/25 | 12/8/25 | 12/16/25 | 4 | $2.21 | $8.84 |

| UNM | Unum Gr | 10/24/25 | 10/24/25 | 11/14/25 | 4 | $0.46 | $1.84 |

| UNP | Union Pacific | 8/29/25 | 8/29/25 | 9/30/25 | 4 | $1.38 | $5.52 |

| UNTY | Unity Bancorp | 9/5/25 | 9/5/25 | 9/19/25 | 4 | $0.15 | $0.60 |

| UPS | United Parcel Service | 11/17/25 | 11/17/25 | 12/4/25 | 4 | $1.64 | $6.56 |

| USB | U.S. Bancorp | 9/30/25 | 9/30/25 | 10/15/25 | 4 | $0.52 | $2.08 |

| UTL | Unitil | 11/13/25 | 11/13/25 | 11/28/25 | 4 | $0.45 | $1.80 |

| UTMD | Utah Medical Products | 12/16/25 | 12/16/25 | 1/5/26 | 4 | $0.31 | $1.24 |

| V | Visa | 11/12/25 | 11/12/25 | 12/1/25 | 4 | $0.67 | $2.68 |

| VALU | Value Line | 10/27/25 | 10/27/25 | 11/10/25 | 4 | $0.32 | $1.30 |

| VMC | Vulcan Materials | 11/10/25 | 11/10/25 | 11/25/25 | 4 | $0.49 | $1.96 |

| VZ | Verizon Communications | 10/10/25 | 10/10/25 | 11/3/25 | 4 | $0.69 | $2.76 |

| WAFD | WaFd | 8/22/25 | 8/22/25 | 9/5/25 | 4 | $0.27 | $1.08 |

| WASH | Washington Trust Bancorp | 10/1/25 | 10/1/25 | 10/10/25 | 4 | $0.56 | $2.24 |

| WCN | Waste Connections | 11/5/25 | 11/5/25 | 11/20/25 | 4 | $0.35 | $1.40 |

| WDFC | WD-40 | 10/20/25 | 10/20/25 | 10/31/25 | 4 | $0.94 | $3.76 |

| WEC | WEC Energy Group | 11/14/25 | 11/14/25 | 12/1/25 | 4 | $0.89 | $3.57 |

| WHR | Whirlpool | 11/21/25 | 11/21/25 | 12/15/25 | 4 | $0.90 | $3.60 |

| WLK | Westlake | 8/19/25 | 8/19/25 | 9/4/25 | 4 | $0.53 | $2.12 |

| WM | Waste Management | 9/12/25 | 9/12/25 | 9/26/25 | 4 | $0.82 | $3.30 |

| WMS | Advanced Drainage Systems | 12/1/25 | 12/1/25 | 12/15/25 | 4 | $0.18 | $0.72 |

| WRB | WR Berkley | 9/22/25 | 9/22/25 | 9/30/25 | 4 | $0.09 | $0.36 |

| WSBC | Wesbanco | 9/5/25 | 9/5/25 | 10/1/25 | 4 | $0.37 | $1.48 |

| WSM | Williams-Sonoma | 10/17/25 | 10/17/25 | 11/21/25 | 4 | $0.66 | $2.64 |

| WSO | Watsco | 10/16/25 | 10/16/25 | 10/31/25 | 4 | $3.00 | $12.00 |

| WTFC | Wintrust Financial | 11/6/25 | 11/6/25 | 11/20/25 | 4 | $0.50 | $2.00 |

| WTS | Watts Water Technologies | 12/1/25 | 12/1/25 | 12/15/25 | 4 | $0.52 | $2.08 |

| XEL | Xcel Energy | 9/15/25 | 9/15/25 | 10/20/25 | 4 | $0.57 | $2.28 |

| XYL | Xylem | 8/28/25 | 8/28/25 | 9/25/25 | 4 | $0.40 | $1.60 |

| ZION | Zions Bancorp | 11/13/25 | 11/13/25 | 11/20/25 | 4 | $0.45 | $1.80 |

| ZTS | Zoetis | 10/31/25 | 10/31/25 | 12/2/25 | 4 | $0.50 | $2.00 |

In 2024, McCormick & Company (MKC), Norwood Financial (NWFL), RGC Resources (RGCO), and John Wiley & Sons (WLY) were added to the list of Dividend Champions.

Additions and Deletions to the Dividend Contenders

Numerous additions are made to the Dividend Contenders list each year. Due to the large number of companies involved, we are not tracking specific companies. Occasionally, companies fall off the list because they cut or suspended their dividends.

Other Dividend Stock Lists

I have also written about other US stock lists, including

For Canadian stocks, we have an article on

For UK stocks, we have an article on

Other dividend stock lists

FAQs About the Dividend Contenders 2025

What Do We Like About the Dividend Contenders 2025?

The Dividend Contenders 2025 list serves as a screen for further investigating a stock for a dividend growth portfolio. They are companies with stable businesses that have competitive advantages. Moreover, they have returned cash to shareholders consistently through dividends and, in many cases, share buybacks. In addition, many of these companies are not yet mature and are still on decent growth trajectories, resulting in good dividend growth and stock price appreciation.

The Dividend Contenders 2025 List is not as exclusive as the Dividend Kings 2025, Dividend Champions 2025, or Dividend Aristocrats 2025 lists.

The Dividend Contenders 2025 list changes annually. Only a few companies graduate to the Dividend Champions list each year. However, a decent number of companies attain the 10-year mark, adding to the list from the Dividend Challengers list.

Affiliate

Portfolio Insight is a leading portfolio management and research platform.

- 9,000+ stocks and ETFs in its database

- Access up to dozens of metrics, 20-years of financial data from S&P Global, fair value, margin of safety, charting, etc.

- Avoid dividend cuts with the Dividend Quality Grade and screening tools.

Click here to try Portfolio Insight for free (14-day free trial).

Dividend Contenders Sector Breakdown

Companies from the Financial Sector have the most significant representation on the Dividend Contenders 2025 list with 120 companies. Industrials follow this sector with 63 companies, Utilities with 31 companies, Technology with 28 companies, and Consumer Cyclical with 25 companies. The top three sectors have stayed the same in the past few years.

Financials tend to have stable and generally rising earnings over time, except for recessions. Many financial companies cut, froze, or suspended dividends during the Great Recession. However, many also restarted dividend growth as soon as the recovery began. Thus, they are now at ten years or more of consecutive dividend increases, allowing them to enter the Dividend Contenders list. This fact is especially true of regional banks, the number one industry on the list.

Industrial companies tend to have more volatile earnings and cash flows, but many have low payout ratios, allowing them to grow dividends during recessions and economic downturns. The specialty industrial machinery category has a high number on the list.

On the other hand, Utilities tend to have stable and regular cash flow and earnings over long periods. They do not grow quickly but slowly and steadily. Utilities provide a necessary service and product. Both regulated electric and diversified utilities have significant representation on the list.

Market Size of the Dividend Contenders 2025

Large-cap companies do not dominate the list, which includes quite a few mid-cap ($2 billion – $10 billion) and small-cap ($300 million – $2 billion) companies.

The largest of the Dividend Contenders in 2025 by market capitalization is Apple (AAPL), the consumer electronics and software giant. The company has increased the dividend for 13 years in a row. Number two on the list is Microsoft (SOFT), the software and hardware behemoth that has raised its dividend for 23 straight years. Both companies will likely become Dividend Aristocrats and Dividend Champions.

A few companies are on the Dividend Contenders 2025 list with market capitalizations of less than $100M, mainly if we include the over-the-counter (OTC) market. Investors should be wary when investing in companies with small market capitalization due to the associated risks.

Prior Year Lists and Articles

Here are my recommendations:

Affiliates

- Simply Investing Report & Analysis Platform or the Course can teach you how to invest in stocks. Try it free for 14 days.

- Free Dividend Kings Spreadsheet from Sure Dividend, complete with Buy/Hold/Sell recommendations, dividend histories, and much more. It is an excellent resource for DIY dividend growth investors and retirees.

- Stock Rover is the leading investment research platform with all the fundamental metrics, screens, and analysis tools you need. Try it free for 14 days.

Receive a free e-book, “Become a Better Investor: 5 Fundamental Metrics to Know!” Join thousands of other readers !

*This post contains affiliate links meaning that I earn a commission for any purchases that you make at the Affiliates website through these links. This will not incur additional costs for you. Please read my disclosure for more information.

Prakash Kolli is the founder of the Dividend Power site. He is a self-taught investor, analyst, and writer on dividend growth stocks and financial independence. His writings can be found on Seeking Alpha, InvestorPlace, Business Insider, Nasdaq, TalkMarkets, ValueWalk, The Money Show, Forbes, Yahoo Finance, and leading financial sites. In addition, he is part of the Portfolio Insight and Sure Dividend teams. He was recently in the top 1.0% and 100 (73 out of over 13,450) financial bloggers, as tracked by TipRanks (an independent analyst tracking site) for his articles on Seeking Alpha.

Nicole Byers is an entertainment enthusiast! Nicole is an entertainment journalist for the Maple Grove Report.